Green Energy Tax Credits in Canada

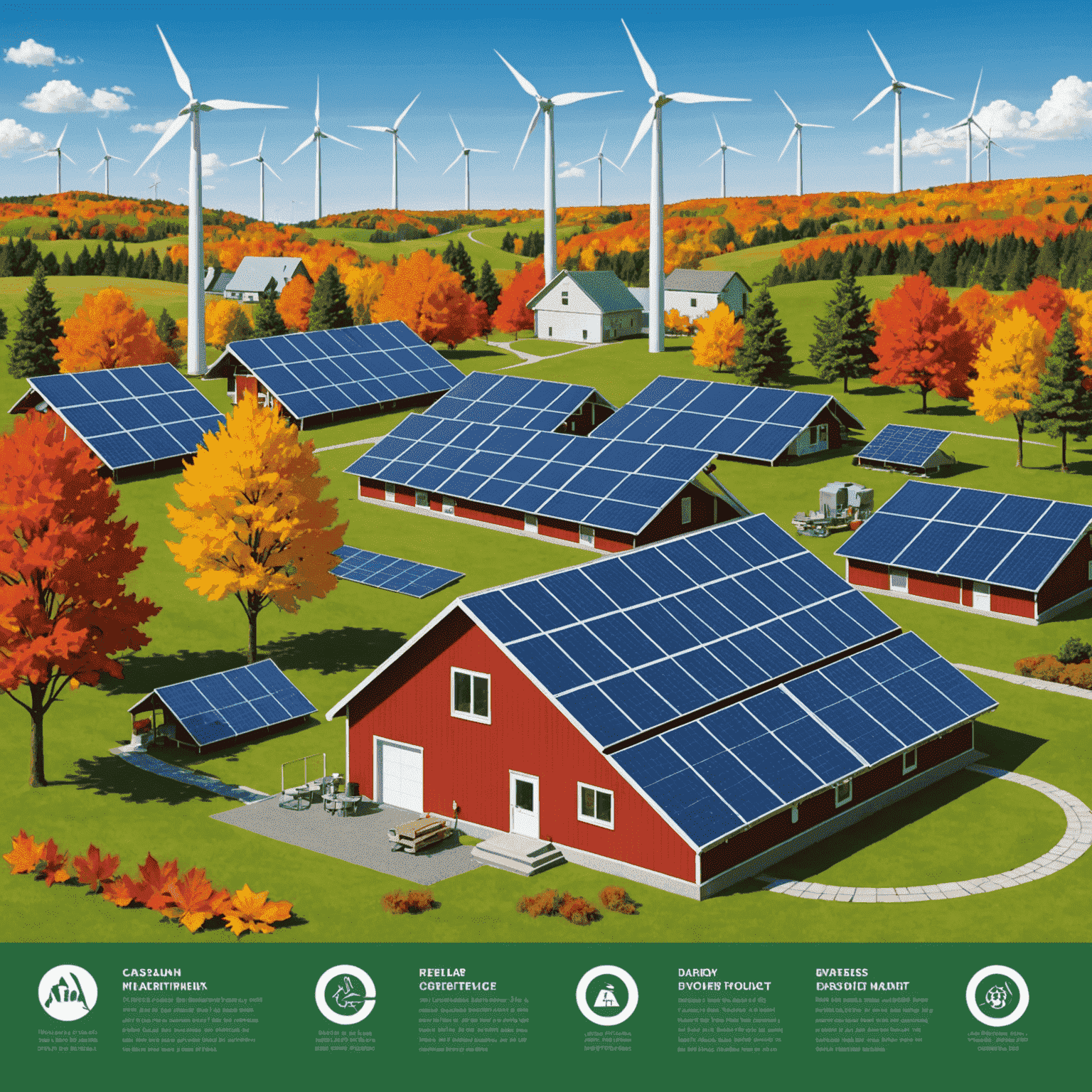

As Canada continues to prioritize sustainable energy solutions, both federal and provincial governments offer a range of tax credits to incentivize the adoption of renewable energy technologies. This comprehensive guide will walk you through the available options, helping you make informed decisions about green energy investments.

Federal Tax Credits

Clean Energy Equipment Incentives

The federal government offers accelerated capital cost allowance rates for businesses investing in specified clean energy equipment. This includes:

- Solar energy equipment

- Wind turbines

- Small hydro-electric installations

- Geothermal energy equipment

- Electric vehicle charging stations

Scientific Research and Experimental Development (SR&ED) Program

Companies developing innovative green energy technologies may be eligible for tax credits through the SR&ED program, which supports research and development activities.

Provincial Tax Credits

British Columbia

B.C. offers the Innovative Clean Energy (ICE) Fund, which provides funding for clean energy projects and technologies.

Ontario

The Ontario Energy and Property Tax Credit (OEPTC) helps low to moderate-income residents with property taxes and the sales tax on energy.

Quebec

Quebec offers the RénoVert tax credit for eco-friendly home renovations, including the installation of solar panels and geothermal systems.

Alberta

The Alberta Indigenous Green Energy Development Program provides grants for Indigenous-led renewable energy projects.

How to Claim Your Tax Credits

- Keep detailed records of all green energy investments and related expenses.

- Consult with a tax professional familiar with renewable energy incentives.

- File the appropriate forms with your annual tax return.

- Be prepared to provide additional documentation if requested by the Canada Revenue Agency.

Green Tariff Programs

In addition to tax credits, many provinces offer green tariff programs that provide financial incentives for feeding renewable energy back into the grid. Check with your local utility provider for specific programs in your area.

By taking advantage of these tax credits and incentives, Canadians can significantly reduce the cost of adopting renewable energy solutions while contributing to the country's sustainability goals. As government programs continue to evolve, stay informed about new opportunities to support green energy initiatives and benefit from financial incentives.